What Are The SECURE Act Provisions That Affect Taxpayers

What Are The SECURE Act Provisions That Affect Taxpayers

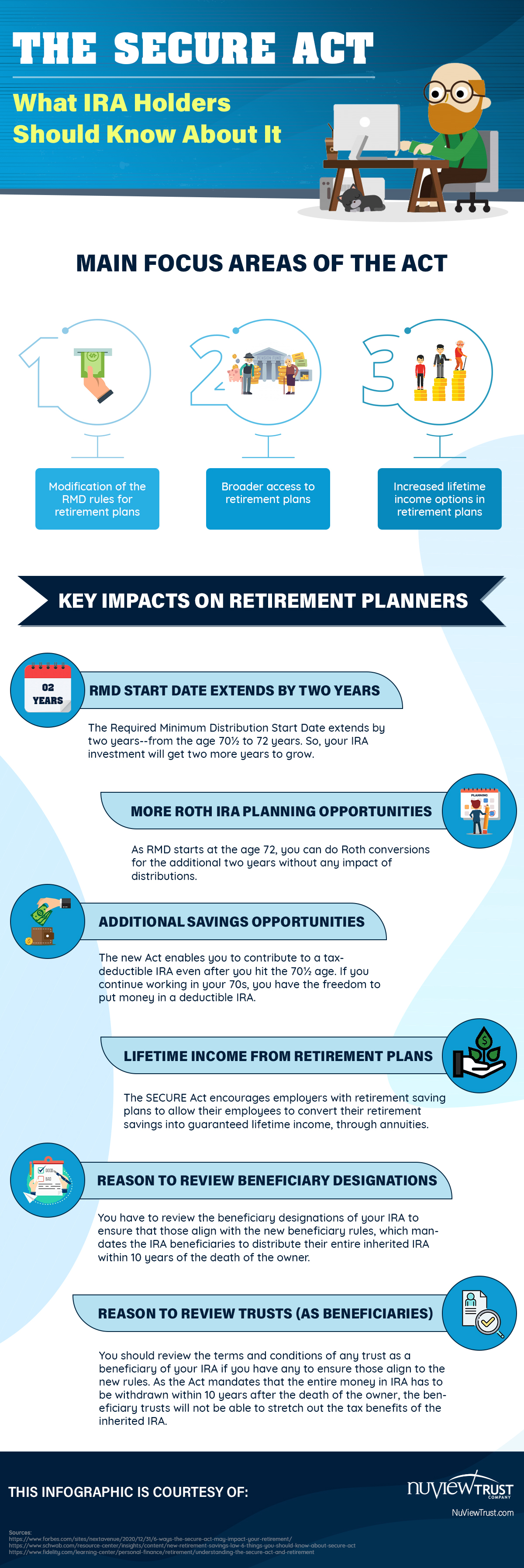

The SECURE Act got signed into law in December 2019. The Act puts light on the outdated provisions for retirement plans and rolls out new ones. The purpose of the Act is to provide benefits of a tax-advantaged account to the majority of the population. And help people have a better and secure post-retirement life.

The following are the SECURE Act provisions that affect taxpayers.

1 – Provisions for required minimum distributions from retirement plans

Earlier, the Americans had to start taking required minimum distributions (RMDs) from their retirement plans when they turned 70½. They had to begin withdrawing their money whether or not they needed it. The old rule took effect in 1960 and never got adjusted to the fact that Americans are living longer. It also stopped the seniors from passing the money on to heirs without touching it or paying taxes. Now, the SECURE Act pushes that age back to 72. Also, some beneficiaries who inherit accounts will need to empty it within ten years from the death of the account holder.

2 – Provisions for growing families

Before the SECURE Act, if you were to make withdrawals before the age of 59½, then you had to pay a tax penalty of 10%. But, some exceptions were depending on the reason for withdrawal. The new Act adds one more exception; if you give birth or adopt a child, then you can withdraw up to $5,000 in the following year of the event. The money needs to get used for ‘qualifying birth or adoption expenses.’ Also note that these distributions are taxable, but you can re-pay them later to your retirement account.

In essence

Those were the major provisions of the SECURE Act and you need to know every single detail about the SECURE Act as an account holder. In all sense, these changes intend to provide a more comfortable life for retirees as well as working people.